Selling a business is a big decision, and most owners want to know the real cost before they start. One of the most common questions people ask is, how much do brokers charge to sell a business? The answer is not the same for everyone because broker fees depend on many factors like the size of your business, the industry, and the deal’s complexity.

If you are planning to sell your company, it’s important to understand how much do brokers charge to sell a business so you can prepare better, avoid surprises, and make a smart decision about whether hiring a broker is the right move for you.

What Does a Business Broker Do?

A business broker helps owners sell their business by finding buyers, handling paperwork, and guiding the deal from start to finish. They make the selling process easier and less stressful.

Simple Explanation of Their Role

Brokers act like middlemen between sellers and buyers.

- They connect sellers with the right buyers.

- They help set a fair price for the business.

- They prepare documents and handle legal steps.

- They make sure the deal is safe and smooth.

Real-Life Example of How Brokers Help

Think of a small restaurant owner who wants to retire.

- The broker checks the restaurant’s value.

- They find buyers interested in the food business.

- They handle meetings and negotiations.

- Finally, they close the deal and ensure the owner gets paid fairly.

You may also like it:

Personal Finance Guide: Tips for Financial Success

Smart Home Trends: Top Innovations for 2025

Easy Budgeting Tips: Manage Your Money Smartly

How Much Do Brokers Charge to Sell a Business?

The cost of hiring a business broker is usually based on commission, but sometimes it also includes flat fees or upfront charges. Knowing these costs helps sellers plan better.

Average Commission Rates (8–12%)

Most brokers earn through commission after the sale is done.

- The usual range is 8% to 12% of the selling price.

- Smaller businesses often face higher rates.

- Bigger businesses may get lower percentage fees.

- Brokers only earn when the deal is completed.

Flat Fees or Upfront Costs

Some brokers ask for extra charges besides commission.

- A flat fee may cover marketing or listing services.

- Retainer fees are sometimes requested at the start.

- These costs are often non-refundable.

- Not all brokers follow this model, so it’s important to ask early.

Comparison with Real Estate Agents

Broker fees for businesses are higher than real estate agents.

- Real estate agents usually charge 5% to 6% commission.

- Business deals take more time and effort than selling property.

- Valuation, financial checks, and buyer screening make business sales complex.

- This is why business broker rates are higher than real estate.

Factors That Affect Broker Charges

The amount you pay a broker depends on many things. Each business is different, so charges are not the same for everyone.

Size of the Business

Bigger businesses often get lower commission rates.

- Large deals bring in higher total earnings for brokers.

- Smaller businesses may face higher percentage charges.

- The value of the deal decides how much the broker earns.

Industry Type

Some industries cost more to sell than others.

- Businesses in complex fields like healthcare may have higher fees.

- Simple industries like retail may be easier and cheaper to handle.

- Brokers spend more time learning rules and laws in some industries.

Location

Where your business is located also matters.

- Brokers in big cities may charge more due to higher demand.

- Rural areas may have fewer buyers, which means more work for brokers.

- Market competition in the area can also affect fees.

Deal Complexity

Complicated deals take more effort and time.

- If many assets are involved, brokers need extra work.

- Negotiating with multiple buyers increases broker tasks.

- Legal and financial paperwork adds to the workload.

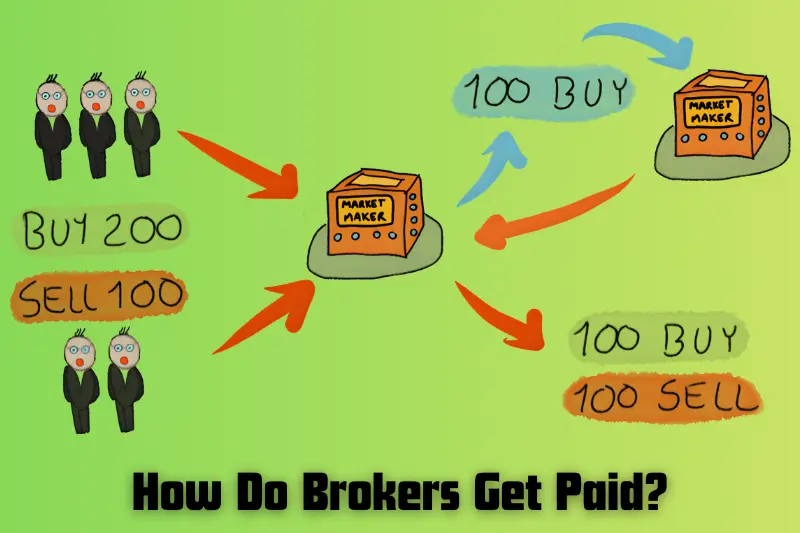

How Do Brokers Get Paid?

Business brokers have different ways of charging for their services. Knowing how they get paid helps sellers plan their costs before making a deal.

Commission-Based

This is the most common way brokers earn money.

- They take a percentage of the final selling price.

- The usual rate is between 8% and 12%.

- Brokers only get paid if the business is sold.

- This motivates them to work harder to close the deal.

Retainer Fees

Some brokers ask for upfront payment before starting work.

- Retainer fees cover the broker’s time and effort early on.

- They may include costs for marketing and listing.

- These fees are usually non-refundable.

- Not all brokers ask for retainers, but some do.

Success Fees After Closing

Brokers may also charge extra when the deal is finalized.

- Success fees are added on top of the commission.

- They are linked to hitting certain deal values or targets.

- Sellers only pay this once the business is sold.

- It acts as a reward for brokers when they close a strong deal.

Pros and Cons of Hiring a Business Broker

Hiring a business broker can make selling easier, but it also comes with some downsides. Let’s look at both sides.

Benefits of Hiring a Business Broker

Brokers bring experience and connections that save owners time.

- They handle marketing, paperwork, and buyer screening.

- Brokers give access to more buyers than most owners can reach alone.

- They use negotiation skills to help sellers get a better deal.

- Their guidance reduces stress and mistakes in the selling process.

Downsides of Hiring a Business Broker

The service comes with costs and limits for the seller.

- Brokers charge high commission rates, usually 8–12%.

- Some sellers feel too dependent on the broker’s choices.

- Owners may not have full control over how the business is presented.

- The cost can be heavy for small business sales.

Tips to Reduce Broker Charges

Business broker fees can feel high, but there are smart ways to lower the cost. Here are some practical tips.

Negotiate Fees

Always try to discuss the fee structure before signing.

- Many brokers are open to reducing their percentage.

- You can ask for a sliding scale based on the sale price.

- Negotiation works best if your business is large or attractive to buyers.

- Being clear upfront avoids hidden costs later.

Compare Multiple Brokers

Don’t settle for the first broker you meet.

- Talk to at least three brokers to compare fees.

- Check what services are included in their cost.

- Some may charge lower commissions but offer the same support.

- Comparing helps you find the best value for money.

Choose the Right Deal Structure

The way your deal is planned can affect costs.

- Success fees or flat fees may work better than high commissions.

- Ask if fees can be linked to performance or sale value.

- Splitting payments between upfront and final fees can reduce pressure.

- A clear structure makes costs easier to manage.

Is Hiring a Broker Worth the Cost?

Many business owners worry about broker fees, but in most cases, the value they bring is greater than the cost. Let’s look at why.

Long-Term Value of a Broker

Brokers add more benefits than just finding buyers.

- They help sellers get higher prices through skilled negotiations.

- Their wide network brings in serious and qualified buyers.

- Brokers save months of time by handling complex steps.

- Avoiding mistakes during legal and financial checks can save huge losses.

Example of a Business Owner

Real stories show how brokers can pay for themselves.

- A small café owner wanted to sell for $150,000.

- With a broker’s help, the business sold for $200,000.

- Even after paying 10% commission ($20,000), the owner earned $30,000 more.

- The broker’s skills brought in a better deal than the owner could get alone.

Conclusion

Selling a business is a big step, and knowing how much do brokers charge to sell a business helps you plan better. Broker fees may seem high, but their experience, buyer network, and negotiation skills often bring more value than the cost.

In the end, choosing the right broker can save you time, reduce stress, and help you get the best deal for your business.

Frequently Asked Questions (FAQs)

How much do brokers charge to sell a small business?

Broker fees for small businesses usually range between 8% and 12% of the sale price. The exact fee depends on the size, industry, and complexity of the deal. Smaller businesses often pay higher rates compared to larger ones.

Do brokers charge upfront fees?

Yes, some brokers may charge upfront or retainer fees. These fees help cover marketing costs and time spent preparing the business for sale. However, not all brokers require them, so it’s important to ask before agreeing to work with them.

Can I sell my business without a broker?

Yes, it’s possible to sell your business without a broker, but it’s much harder. You would need to find buyers, handle negotiations, and ensure all legal requirements are met yourself. Brokers bring expertise and a network of buyers, which can make the process faster and easier.

What services do business brokers provide?

Business brokers provide a range of services, including:

Valuing your business to determine a fair price.

Marketing your business to a wide pool of buyers.

Screening buyers to ensure they are serious and capable.

Negotiating terms to get the best deal.

Handling paperwork and legal requirements to avoid mistakes.

How long does it take for a broker to sell a business?

The timeline can vary depending on the business type, market conditions, and the broker’s network. On average, it may take between 6 months to a year to sell a business. Brokers help speed up the process by reaching more buyers and handling negotiations.

Can I negotiate broker fees?

Yes, broker fees are often negotiable, especially for larger businesses or if you are working with a broker who is eager to secure your business. It’s worth discussing fees upfront and asking if they can be adjusted based on the sale price or complexity.

What happens if a broker doesn’t sell my business?

If a broker doesn’t sell your business within the agreed-upon time frame, you can discuss your options. Some brokers may offer a performance-based fee that depends on successfully closing a deal. In such cases, you may not owe a fee if no sale is made.

You may also like it:

Saving Money Tips for Students: Master Your Finances Now!

Startup Marketing Strategies: Boost Your Business Fast

Startup Funding Sources: Top Options for Your Business

Aajkitajikhabar.com Business: Insights and Growth | TeckJB com