Starting a business is an exciting journey, but to turn your idea into a successful venture, securing the right startup funding sources is essential. Funding is the lifeblood of any new company, enabling entrepreneurs to cover initial costs, scale operations, and bring their vision to life. However, choosing the right startup funding sources can be tricky. The source of your funding will influence your business strategy, growth potential, and the control you have over your company.

Whether you’re a first-time founder or looking to expand, understanding the various funding options available is key. The right funding source can fuel your growth, while the wrong one can add unnecessary pressure or limit your opportunities. That’s why selecting the right startup funding sources is not just a financial decision—it’s a strategic choice that will shape your business future.

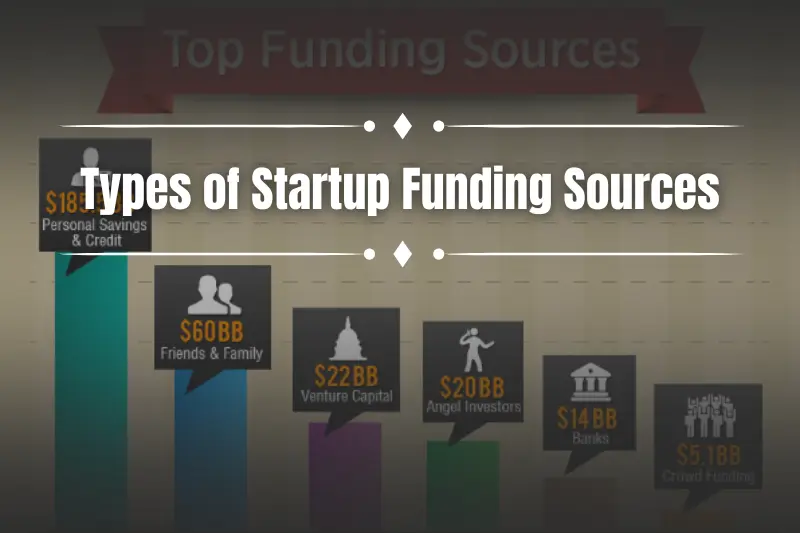

Types of Startup Funding Sources

There are various startup funding sources available to entrepreneurs, each with its own advantages and challenges. Here’s a quick breakdown of the most common options:

- Bootstrapping

- Using your own savings or personal assets to fund your startup.

- No external debt or equity involved, but it can strain personal finances.

- Angel Investors

- Wealthy individuals who invest their own money in exchange for equity or debt.

- Often provide mentorship alongside funding.

- Venture Capital

- Professional firms invest large sums in exchange for equity, usually for high-growth potential startups.

- Best for businesses looking to scale rapidly.

- Crowdfunding

- Raising small amounts of money from a large number of people, typically via platforms like Kickstarter or Indiegogo.

- Allows you to gauge public interest while securing funds.

- Government Grants and Loans

- Financial aid from the government that does not require repayment (grants) or low-interest loans.

- Usually comes with specific eligibility criteria and application processes.

- Bank Loans

- Traditional loans from banks or financial institutions, requiring a solid business plan and collateral.

- Offers larger sums of money but can be difficult to obtain for new startups.

- Corporate Partners

- Large corporations offer funding in exchange for equity, products, or services.

- Can lead to strategic partnerships that benefit both parties.

- Family and Friends

- Borrowing money from personal connections, often without the formalities of other funding sources.

- Risk of personal relationships being strained if the business fails.

You may also like it:

Personal Finance Guide: Tips for Financial Success

Smart Home Trends: Top Innovations for 2025

Easy Budgeting Tips: Manage Your Money Smartly

Bootstrapping: A Common Startup Funding Source

Bootstrapping refers to using your own personal savings or resources to fund your startup without seeking outside investment. It’s a popular choice for entrepreneurs who want to maintain full control over their business without giving away equity or taking on debt.

Here’s a quick look at the pros and cons of bootstrapping:

Pros of Bootstrapping

- Full Control: You retain 100% ownership of your business, making all key decisions without interference from investors.

- No Debt or Interest: Since you’re not borrowing money, there are no monthly repayments or interest charges to worry about.

- Increased Flexibility: Without investors breathing down your neck, you have more freedom to pivot, take risks, and experiment.

- Stronger Motivation: Using your own savings can increase your commitment and drive to make the business successful since your personal money is on the line.

Cons of Bootstrapping

- Personal Financial Risk: If the business fails, you could lose your personal savings, which may affect your personal life.

- Limited Resources: Personal funds might not be enough to cover all startup costs, potentially limiting your growth in the early stages.

- Slower Growth: Without external funding, scaling can be slow since you’re limited by how much personal money you can invest.

- Pressure and Stress: The responsibility of using your own money can create significant stress, especially if the business faces financial challenges.

Angel Investors: A Popular Startup Funding Source

Angel investors are wealthy individuals who provide financial backing to early-stage startups in exchange for equity or convertible debt. These investors are often experienced entrepreneurs or professionals who not only offer money but also valuable guidance and connections.

How Angel Investors Help Startups

- Provide Capital: Angel investors typically invest their own money, helping startups with initial costs, product development, or scaling.

- Offer Mentorship and Guidance: Beyond funding, many angel investors offer valuable industry knowledge and advice, which can be critical for early-stage success.

- Expand Network: They often introduce startups to key business connections, potential customers, or other investors.

- Flexible Investment Terms: Angel investors may offer more flexible and less formal terms compared to venture capitalists, allowing startups to maintain more control.

Examples of Successful Startups That Began with Angel Investors

- Google: Google’s founders, Larry Page and Sergey Brin, received initial funding from angel investor Andy Bechtolsheim, which helped them launch their search engine.

- Facebook: Facebook’s first significant investment came from angel investor Peter Thiel, who invested $500,000 in exchange for equity. This helped Facebook grow into a global social media platform.

- Amazon: Jeff Bezos received early investment from angel investors like Tom Alberg, which helped Amazon expand beyond its initial bookselling business into the e-commerce giant it is today.

Venture Capital: A Major Startup Funding Source

Venture capital (VC) is a form of funding provided by professional investment firms to startups and early-stage companies that have high growth potential. In exchange for capital, venture capitalists typically take equity in the business, often in the form of shares or a stake.

How Venture Capital Differs from Angel Investing

- Investment Size

- Venture Capital: VC firms generally invest larger sums of money compared to angel investors. The funding rounds (Series A, B, C, etc.) can range from hundreds of thousands to millions of dollars.

- Angel Investing: Angel investors typically provide smaller amounts of funding, often in the range of $10,000 to $500,000.

- Investment Stage

- Venture Capital: VC firms invest in startups that have moved past the seed stage and are looking to scale quickly. They typically get involved when the business has a proven product and some market traction.

- Angel Investing: Angel investors usually step in at an earlier stage, helping fund initial operations or product development.

- Level of Involvement

- Venture Capital: VC firms often take an active role in the company, offering strategic advice, governance, and sometimes even management oversight.

- Angel Investing: Angel investors may be involved in offering advice, but their involvement is typically less hands-on than that of VCs.

When Is Venture Capital Appropriate for Startups?

- High Growth Potential: Venture capital is most suitable for startups that have significant growth potential, aiming for rapid expansion or those in industries like technology, healthcare, or fintech.

- Scalability: VC funding is ideal when a startup has a scalable business model that can grow quickly with the right resources and capital.

- Ready for External Control: Startups should be open to giving up some level of control, as VCs often want a say in business decisions, governance, and future strategic moves.

Success Stories of Companies That Grew Through Venture Capital

- Uber: Uber received significant venture capital investment from firms like Benchmark and First Round Capital, helping it expand from a small startup to the global ride-sharing giant it is today.

- Airbnb: Airbnb raised hundreds of millions in VC funding, allowing it to grow from a small room-renting platform to one of the largest online hospitality businesses in the world.

- Spotify: Spotify received multiple rounds of venture capital, fueling its development into a leading music streaming platform with millions of subscribers worldwide.

Crowdfunding: A Modern Startup Funding Source

Crowdfunding is a method of raising capital through online platforms, where individuals contribute small amounts of money to support a project or startup. Popular crowdfunding platforms like Kickstarter and Indiegogo have made it easier for entrepreneurs to access funding by gathering contributions from the public.

Crowdfunding Platforms Like Kickstarter or Indiegogo

- Kickstarter

- A platform designed for creative projects, where entrepreneurs launch campaigns to secure funding from backers in exchange for rewards, early access, or products.

- Ideal for businesses with tangible products or creative projects.

- Indiegogo

- Similar to Kickstarter but offers more flexibility, allowing campaigns for a wide range of business types.

- Provides both “fixed” funding (only keep funds if the goal is met) and “flexible” funding (keep funds regardless of goal achievement).

Benefits of Gaining Public Support and Exposure

- Validation of Ideas: Crowdfunding allows you to test your product or idea with the public before launching, validating if there is genuine interest and demand.

- Direct Feedback: Backers often provide valuable feedback, which can help improve your product or business strategy before you scale.

- Marketing and Exposure: A successful crowdfunding campaign can generate buzz around your startup, helping you reach a wider audience and build brand recognition.

- Access to Early Adopters: Crowdfunding lets you connect with early adopters who are excited about your product and can become loyal customers and advocates.

- Non-Dilutive Funding: Unlike venture capital or angel investment, crowdfunding typically doesn’t require you to give up equity, which means you retain full ownership of your business.

- Increased Credibility: A successful campaign can increase your business’s credibility, making it easier to attract investors, partners, and customers in the future.

Government Grants and Loans: Alternative Startup Funding Sources

Government grants and loans are financial resources provided by local, state, or federal governments to support startups, especially those with potential for innovation, job creation, or economic growth. These funding programs often come with favorable terms compared to traditional loans, such as low or no interest rates.

Government-Backed Funding Programs

- Small Business Innovation Research (SBIR) Program

- Provides funding to small businesses involved in research and development of innovative technologies.

- Aimed at businesses with the potential to commercialize research breakthroughs.

- Small Business Technology Transfer (STTR) Program

- Similar to SBIR, but specifically encourages partnerships between small businesses and research institutions.

- Focused on transferring technology from universities and research labs to the commercial sector.

- Economic Development Administration (EDA) Grants

- Offers grants for projects that promote economic development and create jobs in distressed areas.

- Supports a variety of industries, including tech, manufacturing, and clean energy.

- SBA 7(a) Loan Program

- The most common SBA loan, offering low-interest loans to small businesses for working capital, equipment, and expansion.

- Available for startups and existing businesses in need of capital.

- SBA Microloan Program

- Provides small loans (up to $50,000) to startups, particularly those owned by minorities, women, or veterans.

- Helps cover startup costs, inventory, and other business needs.

Application Process and Eligibility Requirements

- Research Available Programs

- Start by researching available grants and loans on government websites such as Grants.gov or the Small Business Administration (SBA) website.

- Ensure the program aligns with your business goals, industry, and location.

- Prepare a Solid Business Plan

- Most government funding programs require a detailed business plan outlining your business model, goals, financial projections, and the impact of your project.

- Eligibility Criteria

- Eligibility can vary by program, but common requirements include:

- Small business status (fewer than 500 employees)

- U.S. citizenship or permanent residency

- Innovation or technology-focused projects (for research-related grants)

- Financial stability (good credit history for loans)

- Eligibility can vary by program, but common requirements include:

- Complete the Application

- Fill out the required application forms, providing all requested documents, including your business plan, tax returns, and financial statements.

- Many programs require a pitch presentation or proposal.

- Wait for Review and Approval

- After submission, your application will be reviewed, and the government agency will decide whether to approve your funding request.

- This process can take several weeks to months, depending on the program.

Corporate Partners: Collaborative Startup Funding Sources

Partnering with larger corporations can be an effective way for startups to secure funding while gaining valuable resources, exposure, and strategic advantages. These partnerships often involve financial investment, joint ventures, or access to corporate resources, helping startups grow and scale quickly.

How Partnerships with Larger Corporations Can Provide Funding

- Direct Financial Investment: Larger corporations may invest directly in startups through equity funding, providing the capital needed for growth without taking on debt.

- Joint Ventures: Corporations may enter into joint ventures with startups to develop and market new products or services, sharing both the costs and profits.

- Grants and Sponsorships: Some corporations offer grants or sponsorships to support innovation, research, or community-based projects that align with their business objectives.

- Access to Resources: Corporations may offer startups resources such as technology, facilities, or expertise in exchange for equity or a share of profits.

Strategic Advantages of Corporate Collaborations

- Access to Larger Customer Bases: Partnering with a larger corporation gives startups access to a well-established customer base, boosting sales and market reach.

- Credibility and Trust: Being associated with a reputable corporation can lend credibility to your startup, making it easier to attract other investors, partners, and customers.

- Shared Risk and Costs: By collaborating with a corporate partner, startups can share the financial risk of product development or market entry, reducing their own financial burden.

- Innovation and Product Development: Corporations may have advanced technology, expertise, or research facilities that can help accelerate product development or improve existing offerings.

- Strategic Networking: Corporate partners often bring valuable industry connections, opening doors to new business opportunities, collaborators, and potential investors.

- Long-Term Stability: Corporate partnerships can offer more stability than other funding sources, as large corporations often have the financial resources to weather economic fluctuations.

Family and Friends: Personal Startup Funding Sources

Seeking funds from family and friends is one of the most accessible and immediate ways for startups to secure capital. Many entrepreneurs turn to their close connections for financial support, often because it’s easier to approach them compared to traditional investors or banks. However, while this option can offer flexibility, it also comes with risks that should be carefully considered.

Seeking Funds from Close Connections

- Personal Loans or Gifts: Family and friends may offer funds as a loan or a gift to help get your business off the ground. In some cases, they might even forgo formal agreements, making it a quicker and easier option.

- Equity in the Business: Some startups offer family and friends a share of the business in exchange for their investment, allowing them to become stakeholders in the company.

- Less Formal Process: Unlike formal investors or banks, seeking funds from family and friends often involves less paperwork and fewer legal requirements, making it a more straightforward option.

Risks Involved in Mixing Personal Relationships with Business

- Strained Relationships: If the business doesn’t succeed or faces financial struggles, you may risk damaging personal relationships. The pressure to repay debts or meet expectations can lead to tension or conflict.

- Lack of Legal Protection: Without a formal contract or clear terms, both parties may have different expectations regarding repayment or equity shares, leading to misunderstandings or disputes.

- Financial Pressure: Family and friends may have expectations of your business success that can add stress, making it harder to make business decisions without worrying about their opinions or financial well-being.

- Limited Professional Advice: Unlike professional investors, family and friends may not provide valuable business advice or mentorship, which can limit your growth opportunities.

- Risk of Personal Financial Loss: If your startup fails, your loved ones could lose their money, which might result in financial strain for them, especially if they invested more than they could afford to lose.

Choosing the Right Startup Funding Source

Deciding on the right startup funding source is a critical step in your entrepreneurial journey. Each funding option comes with its own set of benefits and challenges, and it’s important to choose one that aligns with your business type, growth plans, and risk tolerance. Here’s how to decide which funding source suits your startup best:

Practical Advice for Choosing the Right Funding Source

- Consider the Type of Business

- Product-Based Businesses: If you’re developing a physical product, crowdfunding platforms like Kickstarter or Indiegogo can be ideal for gaining early support from customers.

- Tech Startups: If you’re in the tech space, angel investors or venture capitalists can provide the funding needed for rapid scaling and product development.

- Service-Based Businesses: For service businesses with low upfront costs, bootstrapping or bank loans can help fund operations without giving up equity.

- Assess Your Growth Plans

- Rapid Growth: If you’re aiming for fast expansion and have a scalable business model, venture capital or corporate partnerships might be the best option, as they offer large sums of funding to fuel growth.

- Steady, Sustainable Growth: For businesses looking to grow at a steady pace, bank loans or family and friends funding may be more suitable, as these options provide reliable but manageable capital.

- Evaluate Your Risk Tolerance

- High Risk, High Reward: If you’re comfortable with giving up equity and involving external stakeholders, venture capital or angel investors might be a good fit. These sources offer large investments in exchange for ownership and control.

- Low Risk, More Control: If you want to maintain control of your business and avoid taking on debt, bootstrapping or seeking funds from family and friends may be the better option.

- Consider Time Constraints

- Quick Access to Capital: If you need quick funds, crowdfunding and family/friends may be your fastest options. On the other hand, bank loans and venture capital can take more time for approval and processing.

- Long-Term Support: If you’re looking for long-term strategic support, venture capital or corporate partners can offer not just funding, but guidance, networking, and growth opportunities.

- Understand the Financial Impact

- Debt vs. Equity: Decide whether you prefer to take on debt, which you’ll have to repay, or give away equity in exchange for capital. Loans (bank loans, SBA loans) typically involve debt, while angel investors and venture capitalists require equity.

- Interest Rates and Repayment Terms: If you opt for a loan, be sure to consider the interest rates and repayment terms. If taking equity investment, ensure you’re comfortable with the level of control you’ll need to share with investors.

Conclusion

So guys, in this article, we’ve covered startup funding sources in detail. From bootstrapping to venture capital, it’s clear that each funding source has its pros and cons. Based on your business model and goals, I recommend starting small and leveraging personal funds or seeking angel investors if you’re aiming for rapid growth.

Don’t rush the process—make sure you choose a funding source that aligns with your business’s needs. Now, it’s time to take action. Evaluate your options and start reaching out to potential investors or funding sources that match your vision!

FAQs: Startup Funding Sources

What is the best funding option for a new startup?

The best funding option depends on your business type and goals. If you’re just starting out, bootstrapping or seeking funds from family and friends might be a good choice. For faster growth, angel investors or crowdfunding can also be effective.

How do I know if I’m ready for venture capital?

Venture capital is typically for businesses with high growth potential and proven products. If you’ve gained some traction, have a scalable business model, and need significant capital, it may be the right time. But remember, you’ll need to give up some control.

Is crowdfunding only for tech or creative projects?

While platforms like Kickstarter are popular for tech and creative projects, crowdfunding can be used for a wide range of businesses. If your product or idea has broad appeal, you can successfully raise funds through crowdfunding. Just be sure to market it well to attract backers.

What’s the difference between angel investors and venture capitalists?

Angel investors typically provide smaller amounts of funding at the early stages in exchange for equity. Venture capitalists, on the other hand, invest larger sums of money and often want more control or oversight. Both can help your startup grow, but venture capitalists are usually involved in more established businesses.

Do I need a business plan to apply for a bank loan?

Yes, a solid business plan is typically required when applying for a bank loan. The bank needs to understand your business model, how you’ll repay the loan, and your long-term strategy. This is important for proving your business’s viability.

Can I apply for government grants and loans if I’m a new business?

Yes, some government grants and loans are available to new businesses, especially those with a strong innovation or job-creation potential. However, the application process can be competitive, and you’ll need to meet specific eligibility criteria. Research the programs to find the best fit for your startup.

What are the risks of using family and friends for funding?

The main risk is that it can strain personal relationships if the business doesn’t succeed. There may also be misunderstandings about expectations if no formal agreement is made. It’s important to set clear terms to avoid complications later.

How can I find angel investors for my startup?

Angel investors can be found through networking events, online platforms like AngelList, or by reaching out to local business incubators. You can also ask for referrals from industry mentors. Be prepared with a pitch and a clear business plan.

You may also like it:

Saving Money Tips for Students: Master Your Finances Now!

Startup Marketing Strategies: Boost Your Business Fast